All Categories

Featured

Table of Contents

I paid right into Social Safety and security for 26 years of significant earnings when I was in the personal market. I do not desire to return to work to get to 30 years of considerable incomes in order to avoid the windfall removal stipulation reduction.

I am paying all of my bills presently yet will do more traveling as soon as I am accumulating Social Safety and security. I think I need to live till about 84 to make waiting an excellent selection.

If your Social Security advantage is genuinely "enjoyable money," instead than the lifeline it acts as for the majority of people, maximizing your advantage might not be your top concern. Yet obtain all the information you can about the expense and benefits of asserting at various ages before making your decision. Liz Weston, Licensed Financial Planner, is an individual finance reporter for Inquiries might be sent to her at 3940 Laurel Canyon Blvd., No.

Cash value can build up and grow tax-deferred inside of your plan. You could utilize those funds for a range of goals later on, consisting of additional retired life earnings, education and learning financing or to assist pay the continuous expenses in your policy. This can be accomplished via policy car loans or withdrawals. It's important to note that exceptional policy loans accumulate rate of interest and minimize cash value and the fatality benefit.

If your cash worth falls short to expand, you may require to pay higher premiums to maintain the policy in force. Plans may supply various options for growing your cash money value, so the attributing rate relies on what you choose and exactly how those alternatives carry out. A set segment makes interest at a specified rate, which may alter with time with financial conditions.

Neither sort of plan is necessarily far better than the various other - it all comes down to your goals and method. Whole life policies may interest you if you like predictability. You recognize precisely just how much you'll require to pay yearly, and you can see just how much cash money worth to anticipate in any type of provided year.

Equity Indexed Life

When analyzing life insurance requires, evaluate your long-lasting goals, your existing and future costs, and your need for protection. Review your goals with your agent, and select the policy that works ideal for you.

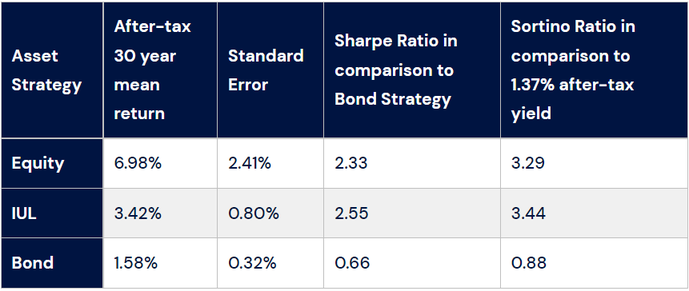

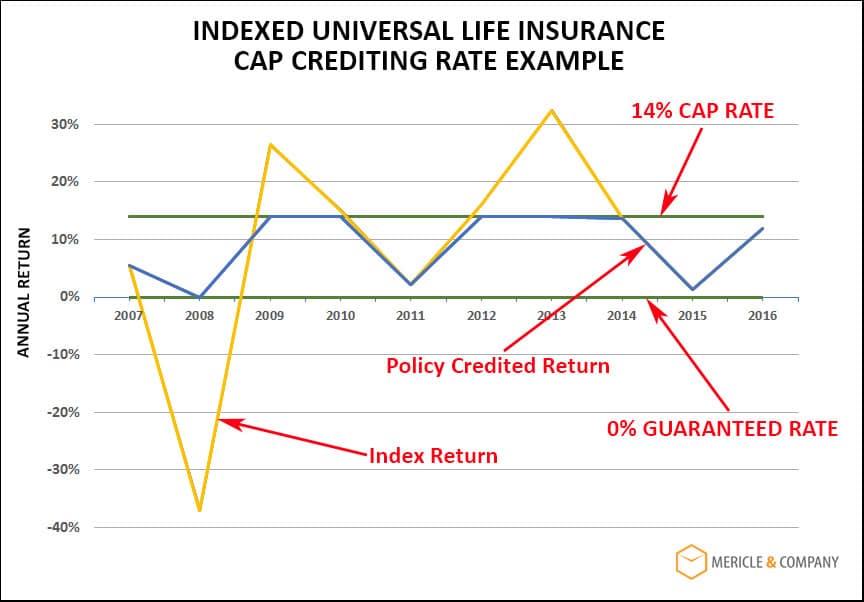

For example, in 2015 the S&P 500 was up 16%, but the IULs growth is capped at 12%. That doesn't sound regrettable. 0% flooring, 12% possible! Why not?! Well, a pair points. First, these IULs neglect the existence of dividends. They consider just the adjustment in share rate of the S&P 500.

Universal Life Surrender Value

Second, this 0%/ 12% game is essentially a shop technique to make it sound like you constantly win, however you don't. 21 of those were higher than 12%, balancing almost 22%.

If you require life insurance policy, purchase term, and invest the remainder. -Jeremy by means of Instagram.

FOR FINANCIAL PROFESSIONALS We've designed to provide you with the finest online experience. Your existing browser could limit that experience. You might be utilizing an old internet browser that's unsupported, or setups within your internet browser that are not suitable with our site. Please save on your own some disappointment, and upgrade your web browser in order to view our site.

Your present web browser: Identifying ...

You will have will certainly provide certain give about yourself concerning your lifestyle in way of life to receive a get universal life global quoteInsurance coverage Smokers can expect to pay higher costs for life insurance than non-smokers.

Fixed Indexed Universal Life

If the plan you're checking out is commonly underwritten, you'll need to complete a medical examination. This exam includes meeting with a paraprofessional that will certainly obtain a blood and pee sample from you. Both examples will certainly be examined for feasible health dangers that can influence the sort of insurance coverage you can get.

Some aspects to think about include the amount of dependents you have, how lots of earnings are entering into your home and if you have expenditures like a mortgage that you would want life insurance policy to cover in the occasion of your fatality. Indexed universal life insurance policy is one of the much more complicated sorts of life insurance policy currently readily available.

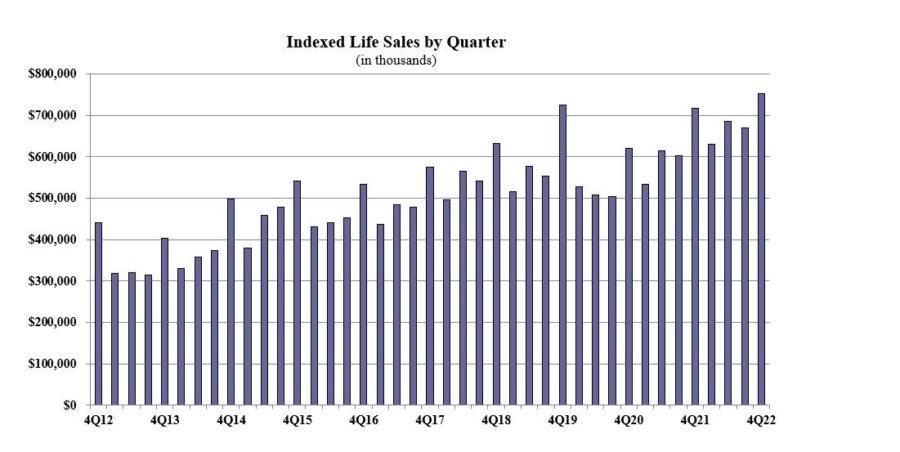

If you're searching for an easy-to-understand life insurance policy plan, however, this might not be your best alternative. Prudential Insurance Provider and Voya Financial are a few of the largest suppliers of indexed global life insurance policy. Voya is thought about a top-tier provider, according to LIMRA's second quarter 2014 Final Premium Reporting. While Prudential is a longstanding, extremely valued insurance firm, having been in business for 140 years.

Guaranteed Universal Life Insurance Rates

On April 2, 2020, "A Critique of Indexed Universal Life" was offered through various outlets, consisting of Joe Belth's blog site. (Belth's summary of the original piece can be discovered below. His follow-up blog site including this write-up can be discovered here.) Not surprisingly, that piece created substantial remarks and criticism.

Some rejected my remarks as being "taught" from my time helping Northwestern Mutual as an office actuary from 1995 to 2005 "normal whole lifer" and "prejudiced versus" items such as IUL. There is no challenging that I benefited Northwestern Mutual. I appreciated my time there; I hold the company, its employees, its items, and its mutual viewpoint in high regard; and I'm happy for all of the lessons I discovered while utilized there.

I am a fee-only insurance consultant, and I have a fiduciary responsibility to keep an eye out for the very best rate of interests of my customers. By interpretation, I do not have a bias toward any type of item, and in fact if I find that IUL makes sense for a customer, after that I have an obligation to not only existing but suggest that option.

I constantly strive to put the most effective foot ahead for my clients, which means utilizing styles that lessen or get rid of compensation to the best level possible within that particular policy/product. That doesn't always mean suggesting the plan with the cheapest compensation as insurance is much more difficult than merely contrasting compensation (and often with products like term or Assured Universal Life there simply is no payment adaptability).

Some suggested that my degree of passion was clouding my reasoning. I enjoy the life insurance coverage industry or a minimum of what it can and ought to be (universal life insurance calculator cash value). And indeed, I have an amazing quantity of passion when it pertains to wishing that the industry does not get yet one more black eye with extremely confident illustrations that set consumers up for frustration or even worse

Cost Of Universal Life Insurance

I might not be able to change or conserve the sector from itself with respect to IUL products, and truthfully that's not my objective. I desire to help my customers make the most of value and prevent crucial blunders and there are consumers out there every day making bad decisions with regard to life insurance coverage and specifically IUL.

Some individuals misinterpreted my objection of IUL as a blanket endorsement of all points non-IUL. This might not be better from the truth. I would not directly suggest the vast majority of life insurance policy policies in the marketplace for my clients, and it is rare to locate an existing UL or WL policy (or proposition) where the presence of a fee-only insurance policy consultant would certainly not include significant client value.

Latest Posts

Group Universal Life Insurance Cash Value

Universal Life Vs Whole Life Which Is Better

Index Universal Life Insurance Uk